Little Known Facts About Paul B Insurance.

Wiki Article

A Biased View of Paul B Insurance

Table of ContentsHow Paul B Insurance can Save You Time, Stress, and Money.The Greatest Guide To Paul B InsuranceMore About Paul B InsuranceWhat Does Paul B Insurance Do?6 Simple Techniques For Paul B InsuranceGetting My Paul B Insurance To Work

represents the terms under which the case will certainly be paid. With residence insurance, as an example, you can have a replacement price or real cash money worth plan. The basis of just how cases are resolved makes a large effect on just how much you make money. You ought to always ask exactly how claims are paid and also what the claims procedure will be.

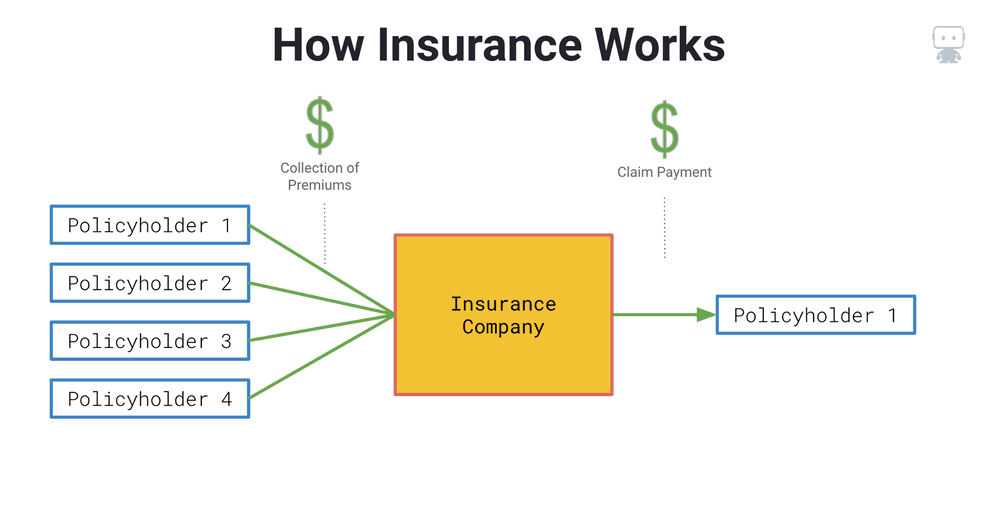

The idea is that the money paid out in cases with time will be much less than the total costs accumulated. You may feel like you're tossing money gone if you never ever sue, but having item of mind that you're covered in the event that you do experience a considerable loss, can be worth its weight in gold.

The 7-Second Trick For Paul B Insurance

Envision you pay $500 a year to guarantee your $200,000 home. This indicates you've paid $5,000 for residence insurance.Since insurance coverage is based upon spreading the risk amongst lots of people, it is the pooled money of all individuals spending for it that enables the company to develop properties as well as cover cases when they happen. Insurance policy is a business. It would be great for the business to just leave prices at the very same level all the time, the fact is that they have to make adequate cash to cover all the potential cases their insurance policy holders may make.

just how much they got in premiums, they have to modify their rates to make cash. Underwriting modifications and also rate rises or decreases are based upon results the insurance policy firm had in previous years. Depending on what company you acquire it from, you may be handling a captive representative. They offer insurance from just one business.

Paul B Insurance for Beginners

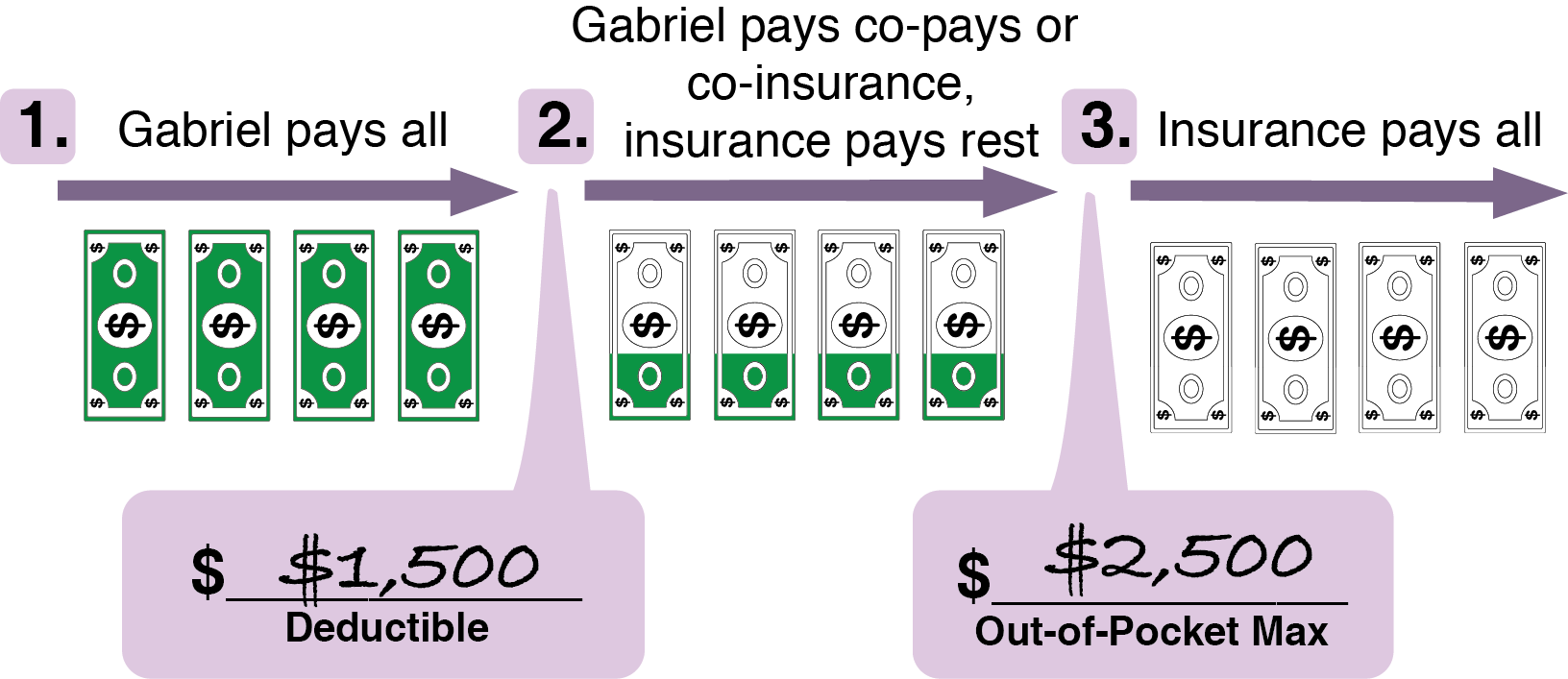

The frontline individuals you deal with when you buy your insurance policy are the agents and also brokers who represent the insurance coverage company. They a familiar with that firm's products or offerings, but can not talk towards other companies' plans, pricing, or item offerings.They will have access to greater than one company as well as need to understand about the variety of items supplied by all the companies they stand for. There are a couple of key questions you can ask on your own that may help you choose what type of coverage you need. Just how much risk or loss of cash can you think on your very own? Do you have the money to cover your expenses or financial debts if you have a mishap? What concerning if your residence or vehicle is messed up? Do you have the cost savings to cover you if you can not work as a result of a mishap or ailment? Can you afford higher deductibles in order to minimize your expenses? Do you have unique requirements in your life that require added protection? What worries you most? Policies can be customized to your needs and also identify what you are most stressed regarding securing.

The insurance policy you require differs based on where you go to in your life, what sort of assets you have, and what your long-term goals and tasks are. That's why it is essential to put in the time to discuss what you desire out of your policy with your agent.

The Single Strategy To Use For Paul B Insurance

If you get a funding to get a vehicle, and afterwards something occurs to the auto, gap insurance policy will repay any kind of portion of your financing that standard auto insurance doesn't cover. Some loan providers require their consumers to carry void insurance coverage.The main purpose of life insurance policy is to offer money for your beneficiaries when you pass away. Yet just how you pass away can establish whether the insurance company pays out the survivor benefit. Depending upon the sort of plan you have, life insurance coverage can cover: Natural fatalities. Dying from a heart attack, condition or old age are instances of natural fatalities.

Life Resources insurance policy covers the life of the insured person. Term life insurance policy covers you for a duration of time selected at click here for more acquisition, such as 10, 20 or 30 years.

Paul B Insurance - The Facts

If you don't die throughout that time, no person earns money. Term life is prominent because it uses large payments at a lower cost than permanent life. It also supplies insurance coverage for a set number of years. There are some variations of common term life insurance policy plans. Exchangeable plans enable you to convert them to permanent life policies at a higher costs, enabling longer and possibly much more adaptable coverage.Irreversible life insurance coverage policies construct cash money value as they age. The cash worth of entire life insurance coverage policies expands at a fixed rate, while the money worth within global plans can change.

$500,000 of whole life insurance coverage for a healthy 30-year-old lady costs around $4,015 every year, on standard. That same level of protection with a 20-year term life plan would certainly set you back a standard of regarding $188 annually, according to Quotacy, a broker agent company.

Some Known Details About Paul B Insurance

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Report this wiki page